#Cash receipts journal manual

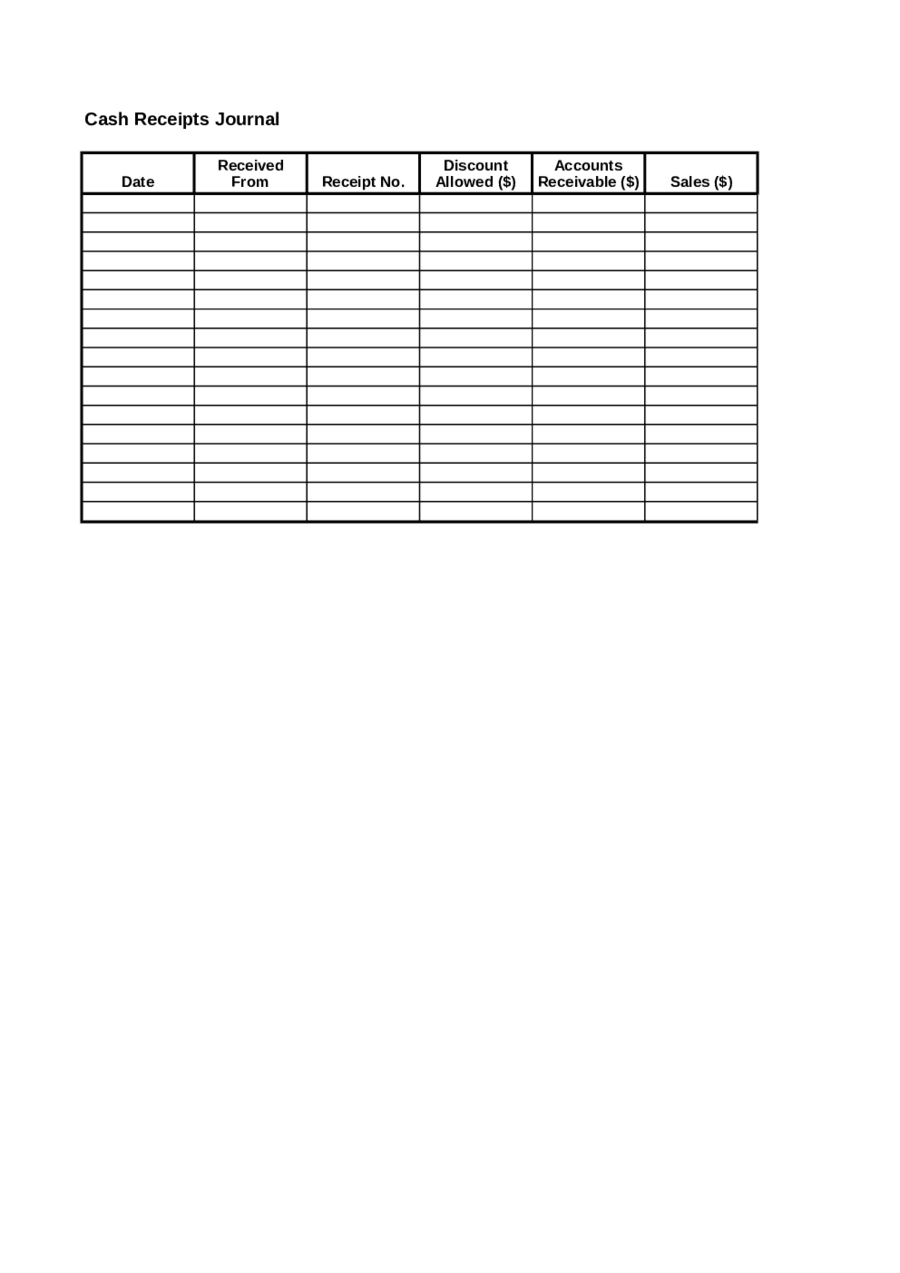

The cash receipts journal is most commonly found in manual accounting systems. Reports -> Sales -> Posting Journals -> Cash Receipts Posting Journal.

If someone needs to investigate a specific cash receipt, they might begin at the general ledger and then move down to the cash receipts journal, from which they might obtain a reference to the specific receipt. I want to print n pages(Payments) by prining once. Question 3 of 20 The total of the trade receivables control account in the cash receipts journal will be posted to the debit side of the trade receivable control account in the general ledger.

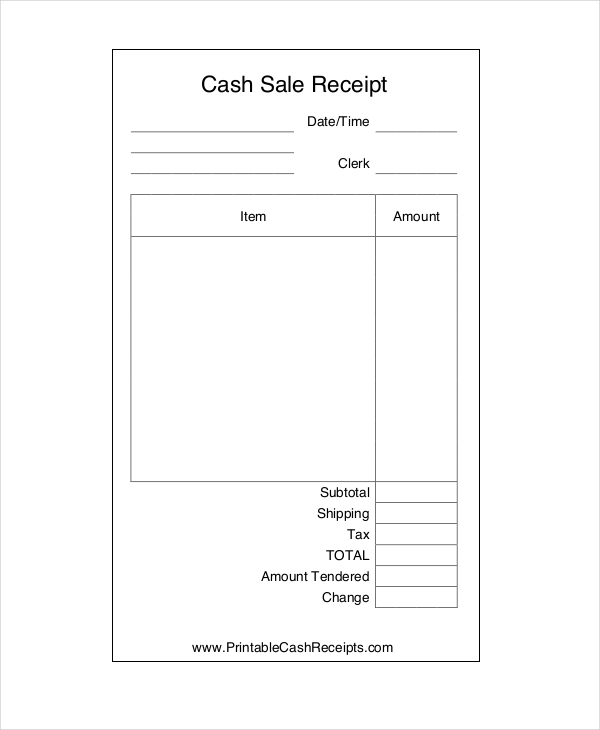

The balance in the journal is regularly summarized into an aggregate amount and posted to the general ledger. There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers. Sample Trust Cash Receipts Journal - Sales. Identification of cash receipt, which may be any of the following:ĭebit and credit columns to record both sides of each entry the normal entry is a debit to cash and a credit to sales A separate Recipt Journal will be kept for Property Sales and Property Management. Choose the icon, enter Cash Receipt Journal, and then. They protect both the University and the. You can also apply from the posted entries later. Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. You can apply the payment to one or more debit entries when you post the payment. You can use it to post transactions to general ledger, bank, customer, vendor, and fixed assets accounts. The journal contains the following fields: A cash receipt journal is a type of general journal. This journal is used to offload transaction volume from the general ledger, where it might otherwise clutter up the general ledger. A cash receipts journal is a subsidiary ledger in which cash sales are recorded. The Cash Receipt Journal detail document shows all cash receipts (including miscellaneous) broken down by bank deposit for the specified period.

0 kommentar(er)

0 kommentar(er)